Using AI Sentiment Analysis in Investment Decisions

In finance, sentiment analysis has become a key tool for investors looking to stay ahead of the game. By examining the emotions and opinions found in news articles, social media, and financial reports, sentiment analysis helps predict market trends. This goes beyond traditional financial analysis, offering a more detailed view of market behavior. The real magic happens when sentiment analysis is combined with advanced AI models, like Retrieval-Augmented Models (RAG).

Sentiment analysis uses natural language processing (NLP) to process large volumes of text, determining whether the sentiment towards a stock, sector, or market is positive, negative, or neutral. Understanding market sentiment is crucial as it often precedes actual market movements. For example, a sudden increase in positive sentiment towards a tech company might indicate good news or strong quarterly results, prompting investors to buy shares before the stock price rises.

Advanced Insights with RAG Models

AI models based on the RAG framework take sentiment analysis up a notch. These models combine the strengths of retrieval-based and generative approaches. The retrieval part ensures the model references the most relevant and recent information from a large database of financial data. Meanwhile, the generative aspect allows the AI to create coherent and contextually rich insights from this data. This combination makes RAG models exceptionally good at understanding complex financial narratives and generating actionable insights, which are crucial for informed investment decisions.

Real-Time Adaptation and Learning

Using RAG-based AI in sentiment analysis systems can lead to more precise and timely investment strategies. These models can continuously learn and adapt to new data, keeping investors updated with the latest sentiment trends and market insights. Moreover, RAG models handle ambiguous or conflicting sentiments more effectively, providing a balanced view that reduces the risks of relying too much on a single source of information. As a result, investors can better anticipate market movements, avoid potential pitfalls, and seize new opportunities, leading to better investment outcomes.

Lotus Field Sentiment Analysis

Lotus Field Analytics’ upgraded and sharper sentiment model pinpoints the sentiment of different entities, such as companies, persons, or other organizations, even more precisely than before.

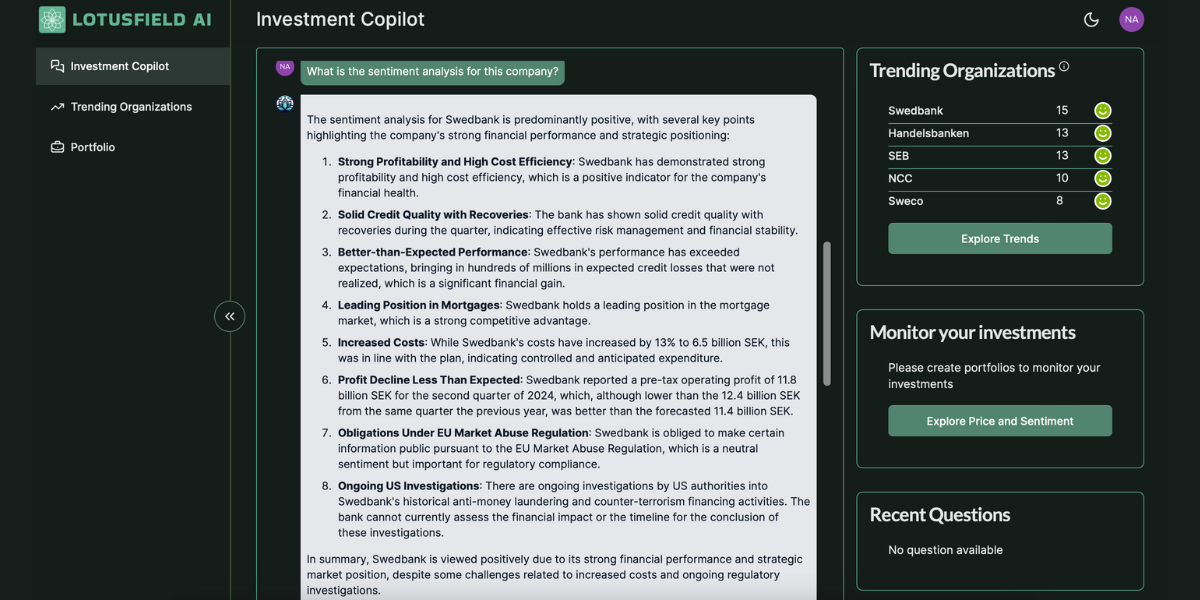

As an example, let’s look at today’s trending companies shown in our Investment Copilot (image 1).

As a potential investor, I might get interested in the top organization—Swedbank in this case. I can then go to the chat and ask the copilot to summarize the sentiment (image 2).

As the next step (image 3), the potential investor might ask the chatbot for a recommendation on whether or not to buy Swedbank’s stocks. Given Swedbank's strong financial performance, high profitability, and leading position in the mortgage market, the chatbot might highlight these as positive indicators. However, it would also note the increased costs, potential negative impact of anticipated interest rate cuts, and ongoing regulatory investigations as significant challenges.

The chatbot recommends a cautious approach, advising investors to consider the strong financial fundamentals while being mindful of the risks. It also suggests diversifying the investment portfolio to mitigate these risks and emphasize the importance of consulting with a financial advisor to make tailored investment decisions. This comprehensive evaluation done in a span of seconds can assist the potential investor in making an informed decision regarding Swedbank's stocks.

In summary, combining sentiment analysis with advanced AI models like RAG is a significant step forward in financial analytics. By using AI to interpret and generate detailed market sentiment insights, investors can make more informed and strategic decisions. As the finance industry continues to adopt these technologies, the ability to quickly and accurately analyze sentiment will become a crucial advantage for serious investors.